LABOR FORCE

Based on the 2015 Census of Population, labor force 15-64 years old in the city is 71.16% of the total population and 64.45% is gainfully employed. Majority of the workers are Service and Sales Workers (19.23%), Clerical Support Workers (18%), working in Elementary Occupations (13.48%), Professionals (12.82%) and Managers (9.84%). In 2020, it is expected that 3.68% (10,110 persons ages 60-64 years old) of the workforce or 2.62% of the total population from the last five years will retire and 7.94% of the total population (with 30,656 persons ages 10-15 years old) can replace the retiring population.

It can be said that quality of labor force is good considering the latest data on local employment services which reported a Placement Rate of 92% in 2017.

Being a highly urbanized city with no more land left for agriculture, the most dominant economic activities are centered on commercial and service center seconded by the industrial sector.

Agricultural activities in the city are done more as a hobby and an effort to combat negative environmental effects and source of domestic kitchen supplies than as a primary source of income. Such agricultural activities are limited to backyard and vertical gardening involving herbs, medicinal plants, vegetables and ornamental plants.

Mandaluyong City’s labor force also includes a number of Overseas Filipino Workers. In 2015, 7,471 Mandalenos or 1.93% of the city population ages 15 and above are working outside the Philippines to provide for their families. 62% are male while 38% are female. 41% of them are below 20 years old and 1.45% of the Total Mandaleño OFW Count are elementary graduate, 25.28% are high school graduate, while 19% are college or vocational undergraduates while almost half of the workers (47.77%) are academic degree or post-baccalaureate holders.

COMMERCE AND INDUSTRY

Commercial Activities

Typical of cities in metropolitan areas, Mandaluyong has its own share of commercial strips and a central business district (see Chapter 2 Zoning Map 4.16). The former, mostly comprising of banks and financing institutions, offices and service establishments stretch along public transport routes thereby serving both local consumers and passers-by from the neighboring localities. Major commercial strips of the city include the stretch of Boni Avenue, Shaw Boulevard, Libertad-Sierra Madre area, Kalentong, San Francisco, part of Martinez, Sgt. Bumatay towards Barangka Drive and Pinatubo towards EDSA.

The city’s Central Business District on the eastern portion of the city is concentrated in the EDSA-Shaw-Pasig Boundary – Pasig River Quadrangle. North of the CBD is a high-density commercial area comprising of establishments such as the Megamall, Shangri-La, Podium and the San Miguel Corporation headquarters.

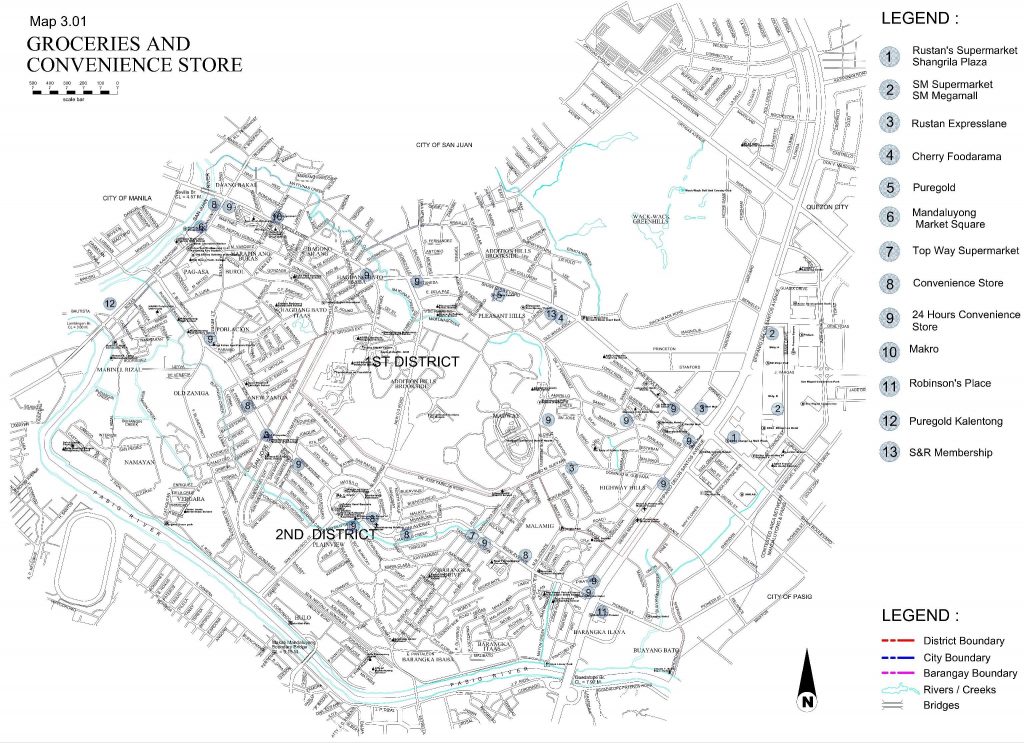

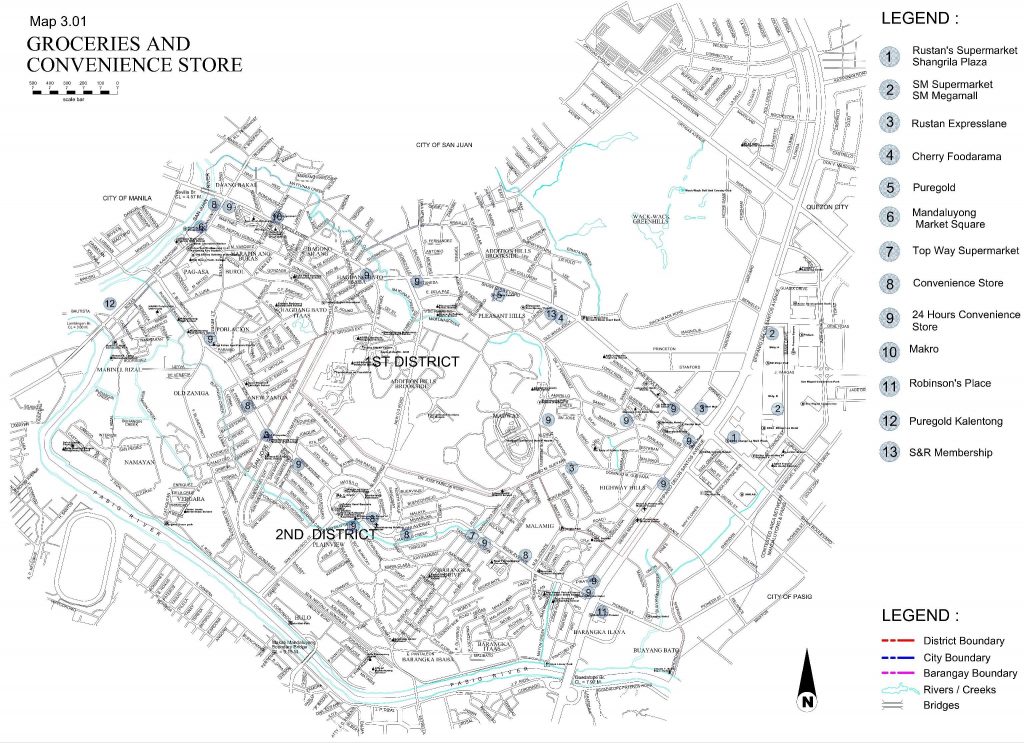

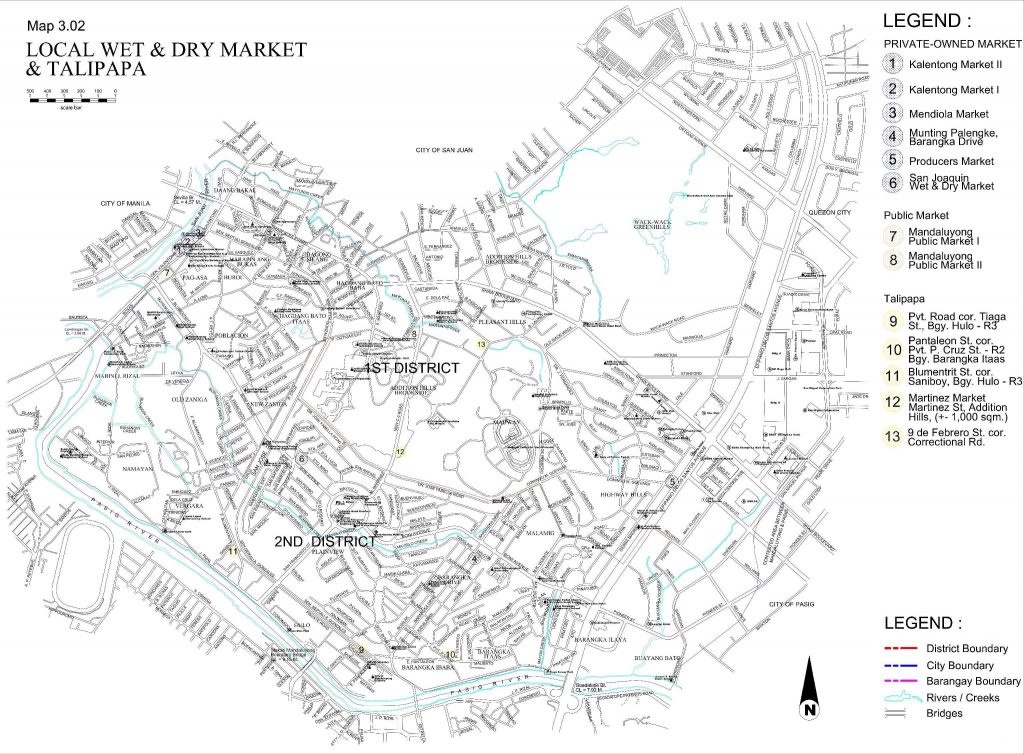

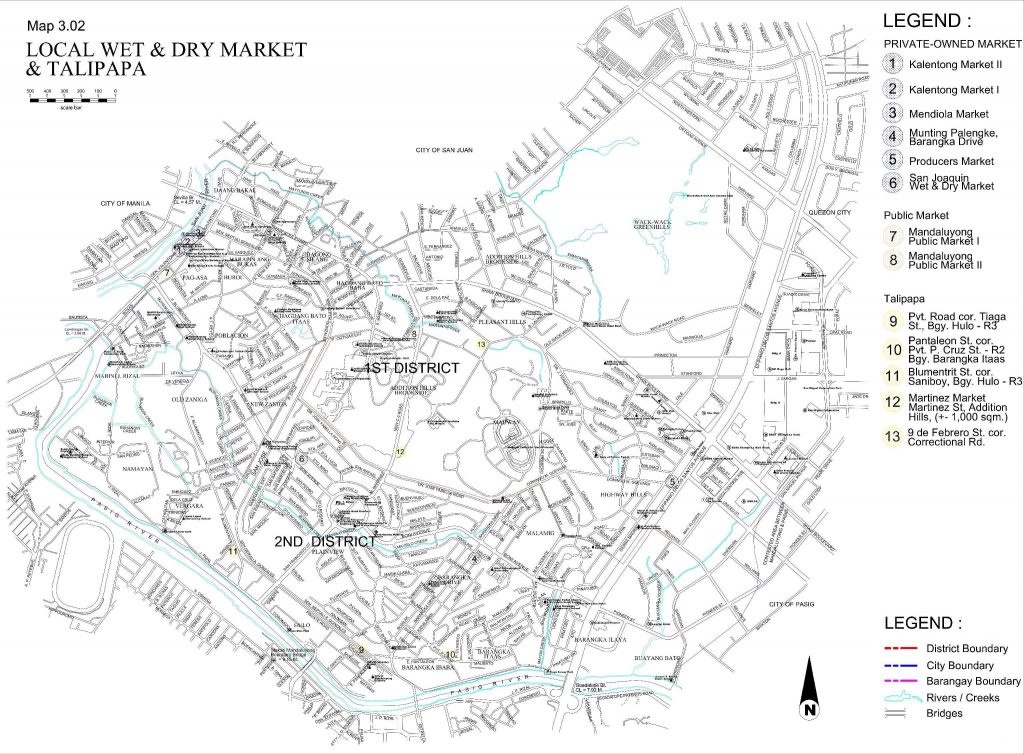

The traditional neighborhood center, on the other hand, is replaced by groceries and convenience stores (Map 3.01,) wet and dry markets (Map 3.02), sari-sari stores, medical and dental clinics, amusement places and other personal services dominating almost all internal roads in the city.

Industrial Activities

These activities are mostly concentrated within the CBD and along Pasig River. Although prominent in the manufacture of foods, medicines and laboratory equipment, these industries are gradually declining in number, opting to relocate in newly-developed industrial zones outside the Metropolitan Manila.

In the Pasig River area, particularly in Barangays Namayan and Mabini J. Rizal, areas formerly industrial are now the sites for residential subdivisions and townhouses. In the EDSA-Shaw-Pioneer area, the transformation is toward a more economically profitable and globally competitive commercial activity.

ECONOMIC DYNAMISM

Rate of Increase of Establishments

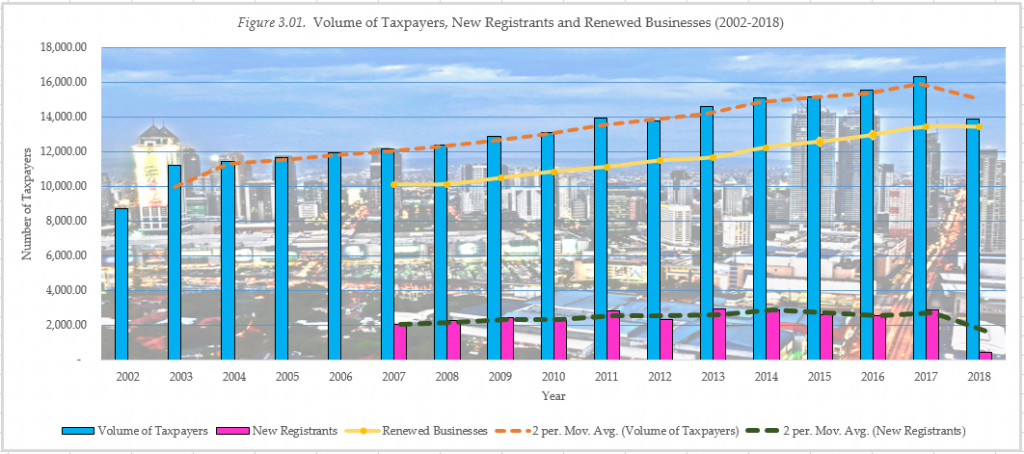

Mandaluyong City was conferred the title “The Tiger Economy” jointly by the Department of Trade and Industry (DTI), Asian Institute of Management (AIM), and SGV Policy Center, because of its vibrant economy as manifested by considerable increase in the number of registered business establishments between 2002 and 2018 (Figure 3.01).

As observed, there is a great leap in the number of business permits issued from 2002 to 2003 which increased steadily since then. By 2007, the number of businesses registered in the city has reached around 12,150. By 2015, the volume of taxpayers from the business sector is recorded at 15,180. These numbers further increased in 2017 as the total volume of taxpayers from the business sector grew to 16,321 wherein 2,896 of them were new registrants and the remaining 13,425 were business renewals supported by a total of 19,640 employees for both new registrants and business renewals.

1. First Asia Realty Development Company

2. Watsons Personal Care Store

3. San Miguel Electric Corp.

4. United Laboratories, Inc.

5. Shangri-La Plaza Corp.

6. Toyota Shaw, Inc.

7. San Miguel Corporation

8. Bank of Commerce

9. Property Company of Friends

10. SMC Global Power Holding Corp.

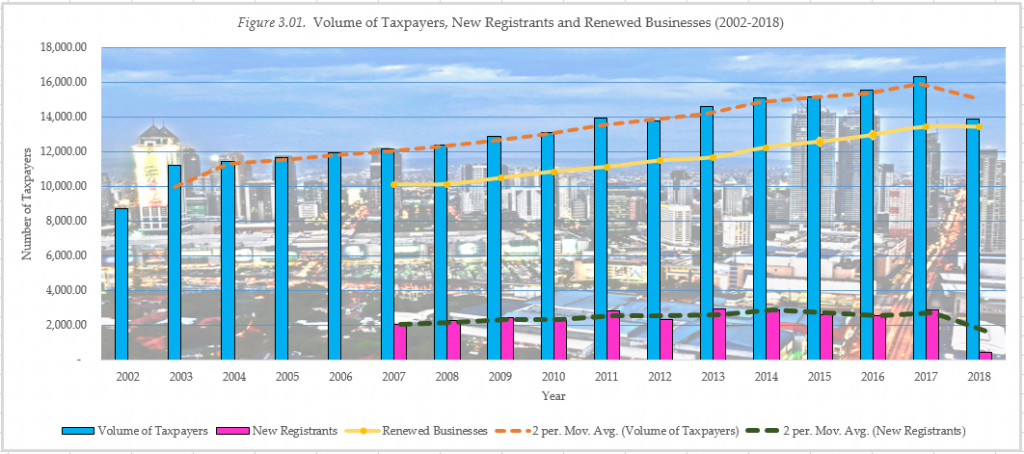

It is expected that the city develops a plan which provides business incentives and higher commercial density and will attract more investors in the years to come. This is slowly being realized with the upsurge of investments especially in the development of the EDSA-Pioneer area into a major economic zone that could generate income and propel further growth and development in the entire city. Likewise, support services such as fast-food establishments, internet service providers, ICT Centers as well as financial institutions now proliferate in the city. It is worth noting, that in conjunction to the influx of investments is the overwhelming increase in assessed values of real property in the city. These can be attributed to the magnitude of structural improvements not only on prime lots but also at random parts of the city where mixed developments of residential and office/commercial condominiums up to seven (7) storeys in height are allowable. This is manifested by major development projects that sprouted in the city just until recently (see Chapter 6 Table 6.02.) Figure 3.01 shows an excerpt from the 2018 Cities Competitiveness Index detailing the rates of utilities, fuel, cost of land per square meter and labor, cost of rent, and other common inputs in production that will give an overview of the cost of doing business in the city.

Business Regulatory Measures

To regulate business establishments and facilitate transactions for business permits, taxes and clearances, the city government passed the following legislations:

In relation to these, and in compliance to the Anti-Red Tape Act of 2007, the city endeavors to make civil applications customer - friendly with requirements and procedures already explained and printed in large tarpaulins posted in conspicuous places in the city hall. More so, the Mandaluyong Citizens’ Charter was developed and regularly updated in the form of handbooks displayed in various frontline offices and posted in the Official Website of the city. The Tagalog Version of the Citizen’s Charter was published in April of 2018.

Recognizing the bulk of transactions every start of a new year, “OPLAN BILIS BAYAD” is implemented from 7:30 am to 5:00 pm on weekdays and 7:30 am until the last customer is served on weekends from January 9 – 21. The project involved all local offices mandated with civil application processes and operates on a one-stop-shop set-up in the New Executive Building within the City Hall Complex.

A key factor in this noticeable improvement in income is the adoption of a Standard Business Registration Procedure (SBRP) by all local offices and agencies involved in the local business registration process. The SBRP is designed to reduce the processing and issuance of business permits from 27 steps down to 3 main steps and from 3 days down to 15 minutes only for simple transactions with completed requirements, thus, speeding up the registration of business investors in the city.

SUPPORT TO MICRO, SMALL AND MEDIUM ENTERPRISES

Negosyo Center

In compliance to Republic Act No. 10644 otherwise known as the “Go Negosyo Act,” the Mandaluyong City Negosyo Center was established within the City Hall Compound through Ordinance No. 607, S-2015 or the “Tiger City Negosyo Center” and its operation was launched on September 28, 2015.

The main function of the Negosyo Center was to provide or facilitate access to various business development services for MSMEs as a one-stop shop including business registration, business advisory, and business information and advocacy essential for their growth.

As defined in Section 3 of the Go Negosyo Act, MSMEs are any business activity or enterprise engaged in industry, agribusiness and/or services, whether single proprietorship, cooperative, partnership or corporation whose total assets, inclusive of those arising from loans but exclusive of the land on which the particular business entity’s office, plant and equipment are situated, must have value falling under the following categories:

Figure 3.01 Cost of Doing Business in Mandaluyong City: 2018 |

||||||||

|

Cost of Doing Business |

Cost of Electricity |

Commercial |

Peso per Kilowatt Hour |

Local electric cooperative |

Price after minimum per kilowatt hour consumption |

2018 |

8.83 |

|

|

Industrial |

2018 |

7.64 |

||||||

|

Cost of Water |

Commercial |

Peso per Cubic Meter |

Local Utility Service Provider |

Price after minimum per cubic meter consumption |

2018 |

67.61 (VAT Inc) |

||

|

Industrial |

2018 |

75.22 (VAT Inc) |

||||||

|

Price of Diesel as of December 31 per year |

Peso per Liter |

Biggest Gas Station Based on Volume/ Sales in the Locality. |

Price of Diesel at the biggest Gas station in the locality (as of December 31) |

2018 |

38.6 |

|||

|

Regional Daily Minimum Wage Rate |

Agricul- tural |

Plantation |

Value in Peso |

http://www.nwpc.dole.gov.ph/pages/statistics/stat_current_regional.html |

Current Regional Daily Minimum Wage Rate for Non-Agriculture and Agriculture |

2018 |

500 |

|

|

Non-Plantation |

2018 |

500 |

||||||

|

Non-Agricul-tural |

Establishments with more than 10 workers |

Wages by sector: Regional offices of the Department of Labor and Employment |

2018 |

537 |

||||

|

Establishments with 10 workers or below |

2018 |

500 |

||||||

|

Cost of Land in a Central Business District |

Purchased in Peso per square meter |

BIR Zonal Value |

Average purchased value of a piece of land in the central business district in the LGU |

2018 |

61K per sq. m |

|||

|

Cost of Rent |

in Peso per square meter per month |

Rgistered Broker in the locality, Bank, actual tenant or lessee |

Average rental rate per square meter for commercial /office space. |

2018 |

1.6K per sq. m. per month |

|||

|

Source: Mandaluyong Report on ECONOMIC DYNAMISM –Cities Competitiveness Index 2018 |

||||||||

The Mandaluyong Negosyo Center is a partnership operation of the City Micro, Small and Medium Enterprise Development Council and the Department of Trade and Industry. Within October 2015 to December 2017, the Negosyo Center have already assisted 1,462 Business Name Registrations, 82 seminars conducted with 2,487 participants, 8,200 MSMEs assisted, 4,079 jobs for a combination of 2,200 male and 1,879 female clients, 2,927 consultancy services to MSMEs provided, 1,802 clients for Information Awareness, 8 Trade Fairs/Caravans conducted and P3,571,593.00 sales generated.

Livelihood Entrepreneurship Advancement Program (LEAP)

LEAP is a holistic, continuing livelihood program under the Office of the Mayor that provides the following services:

- Livelihood Capital Assistance Program (CAP) which aims to extend financial assistance as start-up capital or for business expansion of budding and would-be micro-entrepreneurs to accelerate and jump start their growth. In 2017, 639 micro-entrepreneurs were assisted with a total capital assistance of ₧ 912,500.00.

- Marketing Assistance through conduct of Trade Fairs and Diskwento Caravans which allows entrepreneurs to showcase and sell their products at discounted prices. Kitchen Yummies, on the other hand, is a locally conceptualized project to assist micro food entrepreneurs showcase their culinary expertise and sell their products in a “banchetto” type food outlets occasionally put up within the city hall compound.

- Capacitating/strengthening of local cooperatives and micro entrepreneurs through conduct of seminars, workshops on strategic planning, basic cooperative courses and entrepreneurship, and forum on the preparation of reportorial requirements for cooperatives.

From its establishment up to the end of 2017, the program has assisted 238 Start-Ups and 532 Expansions with a total of 770 beneficiaries who received Capital Assistance amounting up to P1,126,000.00